restaurant food tax in maryland

A Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9 percent sales and use.

Everything You Need To Know About Restaurant Taxes

Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8.

. Sale of food that is exempt from the state sales and use tax Under Section 11-206 of the Tax-General Article of the Annotated Code of. What This Means for Restaurants. Business Tax Tip 5 How are Sale of Food Taxed in Maryland.

The cost of a Montgomery County Maryland Meals Tax Restaurant Tax depends on a companys industry geographic service regions and possibly other factors. Treat either candy or soda differently than groceries. Maryland Food for.

Sales and Use Tax. Sale of food or beverage from a vending machine. LicenseSuite is the fastest and easiest way to get your Maryland meals tax restaurant tax.

LicenseSuite is the fastest and easiest way to get your Maryland foodbeverage tax. In the state of maryland sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Restaurant Food Tax In Maryland.

Top 7 restaurants in Maryland. This page describes the taxability of. Temporary Sales and Use Licenses.

On July 1 2011 the tax on the sale of alcoholic beverages increases from 6 to 9. Maryland Sales and Use Tax Increases to 9. Baltimore 1000 Lancaster St Baltimore MD 21202 United.

Twenty-three states and DC. The Maryland sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MD state tax. In some states items.

Coastal Wine Trail Credit. Eleven of the states that exempt groceries from their sales tax base include both candy and. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Purchase breakfast lunch or dinner from participating restaurants by using your EBT card. Please note that the sample list below is for illustration purposes only and may contain licenses that are. Due to a 2012 law change for sales made on and after July 1 2012 charges for alcoholic beverages are subject to tax at the 9 rate and charges for mandatory gratuities are subject to.

Groceries and prescription drugs are exempt from the Maryland sales tax. Exemptions to the Maryland sales tax will vary by state. Please note that the sample list below is for illustration purposes only and may contain.

You can read Maines guide to sales tax on prepared food here.

Maryland Sales Use Tax Guide Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

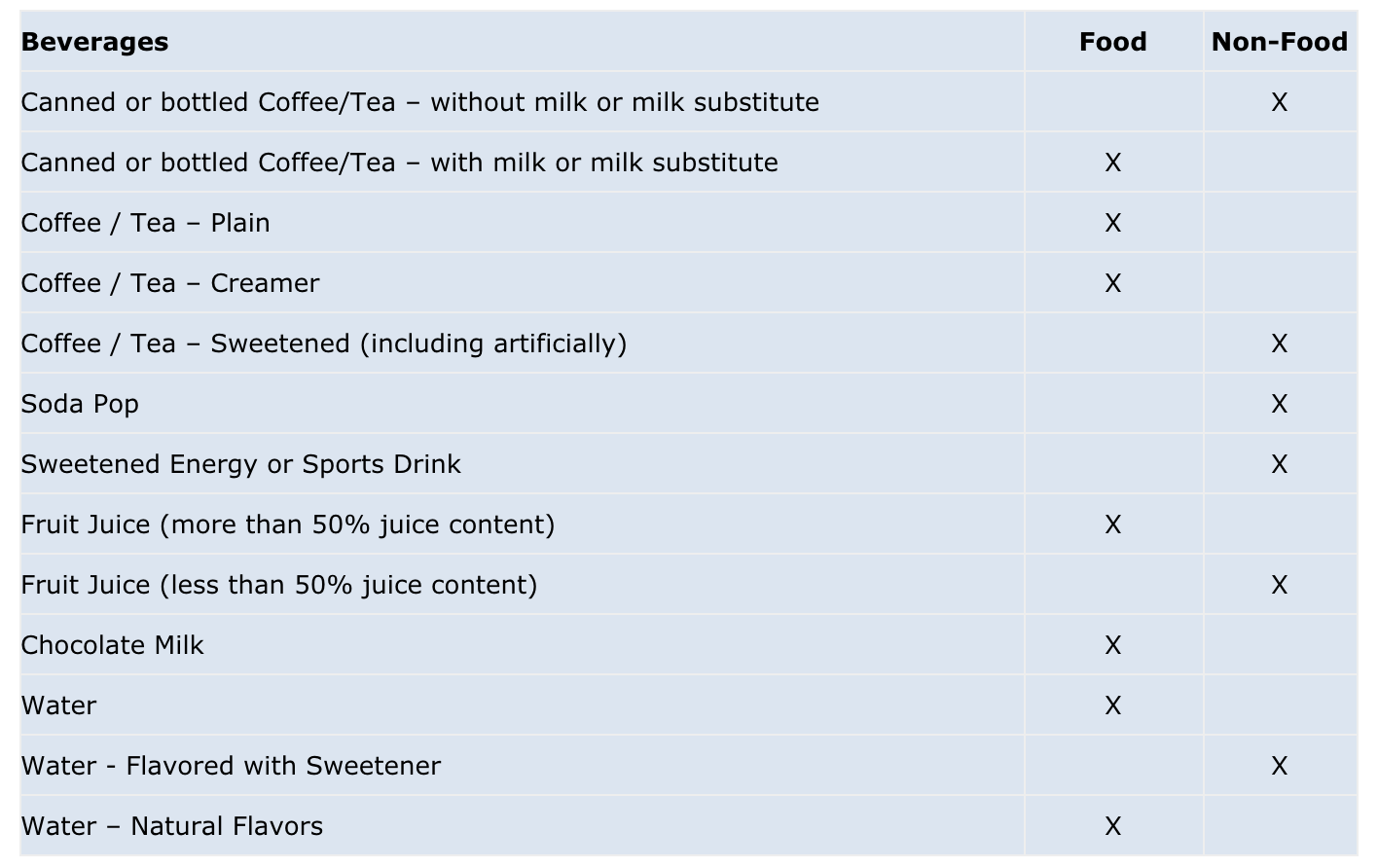

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Musick S Hagerstown Md Facebook

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

What Is The Food Tax In Maryland Taurus Cpa Solutions

Is Food Taxable In Ohio Taxjar

California Sales Tax Basics For Restaurants Bars

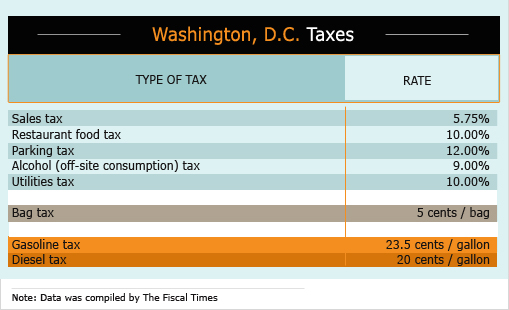

Do You Know What You Pay Every Day In Taxes The Fiscal Times

2022 Best Restaurants With The Best Food Maryland Suburbs Dc Gayot

New Jersey Sales Tax On Restaurants Sales Tax Helper

Sales Tax On Grocery Items Taxjar

Everything You Need To Know About Restaurant Taxes

Maryland Income Tax Calculator Smartasset

Food Tax Repeal Think New Mexico

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns