colorado solar tax credit form

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. 6 Approximate average-sized 5-kilowatt kW system cost in Colorado.

This Site Would Be Your Best Choice When Sourcing From China Their Buyer Service Is Professional And It Offers Th Solar Panels Best Solar Panels Solar Tracker

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

. Unless congress renews the itc extension it passed in december of 2020 this solar tax credit will only be available until 2024. Xcel Energy offers rewards for small medium and large solar installs. Some dealers offer this at point of sale.

If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below. Colorado Solar Tax Credit Form - Colorado state sales tax exemption for solar power systems though the state tax credit is no longer an option for colorado customers solar power systems are exempt from related sales and use taxes. You can take the total cost of your solar system installation and apply 30 to your tax liability for the year.

The credits decrease every few years from 2500 during January 2021 2023 to 2000. There may still be other local rebates from your city county or utility. Instructions Before filing visit the Credits andor Subtractions web page and review all of the corresponding information to verify the qualification criteria appropriate forms and necessary documentation for the credit subtraction or deduction you are claiming.

12720 Approximate system cost in Colorado after the 26 ITC in 2021. As an electric customer you are eligible for a 010 per watt rebate. The residential ITC drops to 22 in 2023 and ends in 2024.

All of Colorado can take advantage of the 26. 2021 Solar Bank Election Form The purpose of this form is to allow you to make an election regarding any excess generation your net metered PV system may or may not produce. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit.

However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate to a residential or commercial property owner who installs a renewable energy fixture on his or her residential or commercial property. State tax expenditures include individual and corporate income tax credits deductions and exemptions and sales and use tax exemptions. Xcel Energy offers the top utility net metering program in Colorado.

This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives including net metering programs and state tax incentives. The federal tax credit falls to 22 at the end of 2022. The federal solar tax credit.

Your equipment AND installation costs for an unlimited amount. Some Colorado utility companies may offer cash rebates for residential solar installations. Federal Tax Credit which will allow you to recoup 26 of.

Colorado Solar Power Performance Payments Performance-Based Incentives. The EZ Investment Tax Credit allows taxpayers to claim an income tax credit for 3 percent of the qualified investment in business property that they make in an enterprise zone. The individual listed on the Xcel Energy account for the premise will benefit from any excess generation produced.

If filing by paper use the forms listed below that corresponds with the subtraction credit or deduction you are. For example EnergySmart Colorado offers 400 3000 rebates depending on where you live. The federal ITC remains at 26 for 2022.

Dont forget about federal solar incentives. This is 26 off the entire cost of the system including equipment labor and permitting. For installations completed until 2023 the tax credit is 26 of solar costs.

Colorado Department of Labor and Employment. For example if you are filing a return for 2018 you must include the credit forms for 2018 with your return. To claim the solar tax credit youll need to first determine if youre eligible then complete IRS form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040.

303-318-8000 Give Us Website Feedback Customer Service Feedback Report. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows. Cost of Installation X 30 Tax Credit.

Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that. While the State of Colorado no longer offers tax credits for residential solar the federal government still provides a 30 Investment Tax Credit for home solar power systems. Step-by step instructions for using IRS Form 5695 to claim the federal solar tax credit.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. The place of installation must be owned by the Colorado Springs Utilities electric customer or in the case of new construction under. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction.

To qualify the investment must be in depreciable property such as manufacturing machinery agricultural structures solar panels and wind turbines. Claiming the federal ITC involves determining your tax appetite and filling out the proper forms. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. 026 18000 - 1000 4420. 633 17th Street Suite 201 Denver CO 80202-3660 Phone.

Colorado Spring Utilities offers an installation rebate of 010 per watt. Depending on the installation up to 40 of your system costs could be covered by rebates and tax credits. Be sure to use the form for the same tax year for which you are filing.

See all our Solar Incentives by. 4 hours agoIf a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Colorado does not offer state solar tax credits.

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Did You Know That Just Being A Mom Can Get You Money Back On Your Tax Return We Didn T Either But The Pros Taught Us The Tric Tax Tricks I Get

Solar Tax Credit Details H R Block

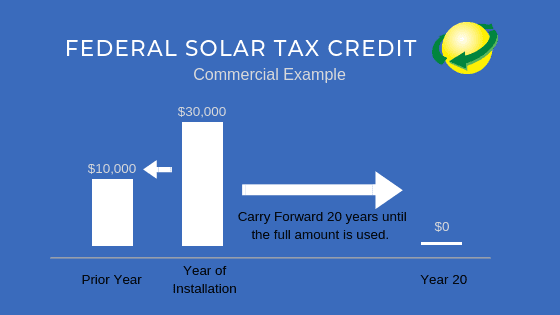

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

How Does The Federal Solar Tax Credit Work Freedom Solar

Solar Sme Inc How Does The Federal Solar Tax Credit Work

Federal Investment Tax Credit Extended Cam Solar Tx Co

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

개인사업자 부가세 환급일 일반환급과 조기환급 Tax Payment Filing Taxes Income Tax

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Investment Tax Credit Extended Cam Solar Tx Co

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

The Extended 26 Solar Tax Credit Critical Factors To Know

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Complyright Copy 2 C 1 Part W 2c Tax Form 531650 In 2022 Tax Forms Form Tax

Federal Solar Tax Credit Guide Atlantic Key Energy

Isometric House Isometric Infographic Inspiration Interior Illustration